Welcome to our FAQ section dedicated to the Two-Pot system for your retirement fund. We understand that managing your retirement savings can be complex, and we're here to help simplify the process. The Two-Pot system offers a flexible and efficient way to structure your retirement savings, ensuring both immediate accessibility and long-term growth. Our FAQ guide is designed to answer your most pressing questions. Explore the topics below to gain a deeper understanding of how the Two-Pot system works, its benefits, and how you can make the most of your retirement funds.

How Does it Work?

Watch this video that explains how the new Two-Pot system will work:

Watch our webinar recap for TSRF Two Pot Learning & The Way Forward held on 13 Nov 2024.

When is the implementation date?

The Two Pot System will be implemented on 01 September 2024.

How will your retirement savings be managed from 1 September 2024?

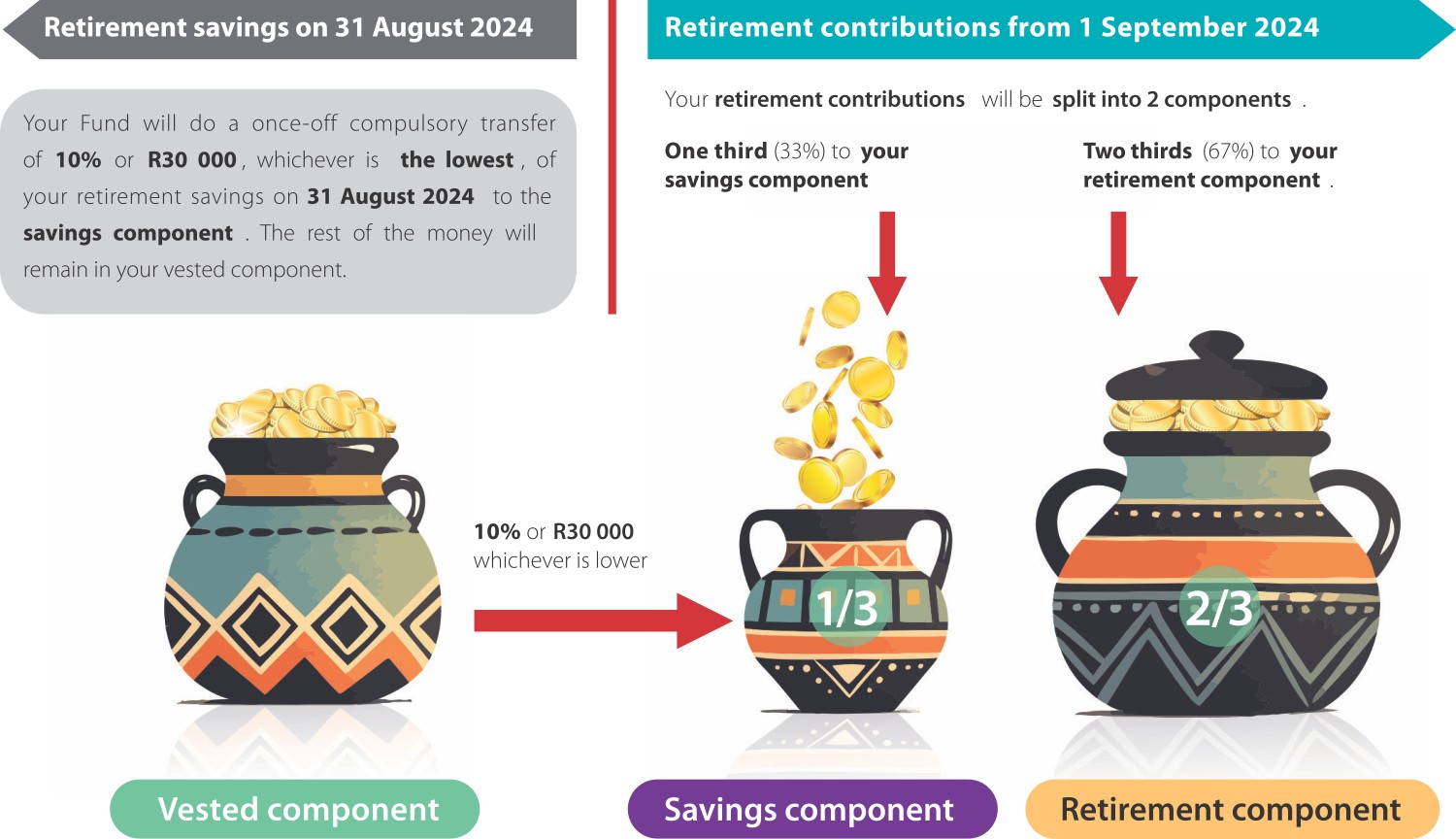

Your retirement savings in your Fund will be divided into 3 components, a vested, savings and retirement component. Different rules apply to each component.

Vested Component

The money in your vested component will still follow the same rules as before.

When you leave your employer you can:

- stay in the Fund as a paid-up member

- take your money in cash

- transfer the money to another fund.

Savings Component

You can withdraw this money as cash lump sum when you retire

OR

You can withdraw only in cases of emergencies, a minimum of R 2,000 (before fees and taxes) once a tax year without leaving the Fund.

There is no maximum withdrawal amount from this pot.

Retirement Component

You cannot withdraw any money from this pot when you leave your employer. The money must remain invested until your retirement.

You must buy a pension with your money when you retire. If the value of all 3 Pots are below R 165,000 you may take the entire benefit in cash.

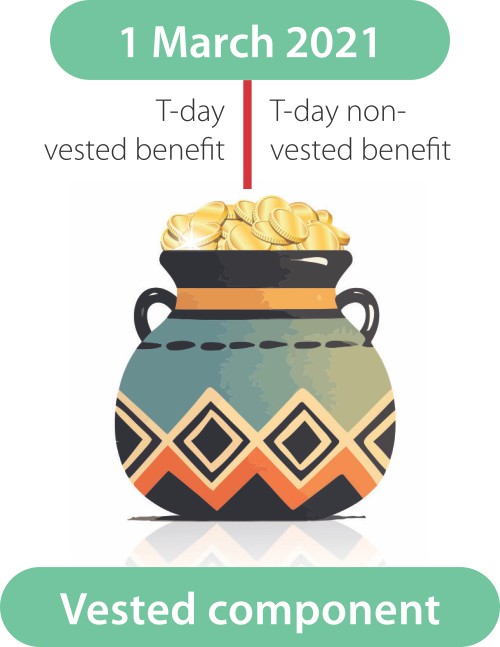

Members who were part of the Fund on 1 March 2021

If you were a member of the Fund on 1 March 2021 (T-day), your vested component will be made up of your T-day vested and T-day non-vested benefit.

When you retire, you may take your full T-day vested benefit, and a maximum of 1/3rd of your T-day non-vested benefit in cash. You have to use the remaining amount in your T-day non-vested benefit to buy a pension, unless that value is below R 247,500 then you may take it in cash.

If you are a member of the Fund and were older than 55 years on 1 March 2021 (T-day)

- If you were 55 years or older on T-day and remained in the Fund, your T-day vested benefit is your Fund savings as at 28 February 2021 and all your retirement savings from T-day. You only have a vested component. You will not have a T-day non-vested benefit.

- If you were older than 55 years on 1 March 2021 you are exempted from the Two-Pot system as you may continue to take all your retirement savings in cash at retirement.

- If you wish to participate in the Two-Pot system (meaning you want to be able to withdraw money from your savings pot) you have to apply to the Fund by completing a Two-Pot Opt In form.

What will happen on 31 August 2024?

Salt Employee Benefits will do a once-off compulsory transfer of 10% or R 30,000 of your retirement savings on 31 August 2024, whichever is the lowest, to your savings component (except for members who were 55 years on 1 March 2021). The rest of the money will remain in your vested component. Let’s look at how your money will be allocated!

| Retirement savings on 31 August 2024 | Amount transferred to your Savings Pot (Component) |

|

R 5,000 R 10,000 R 20,000 R 50,000 R 100,000 R 300,000 R 500,000 |

R 500 R 1,000 R 2,000 R 5,000 R 10,000 R 30,000 R 30,000 |

As seen from the table above - if you have less than R 20,000 as a Fund Credit (retirement savings) as at 31 August 2024 you will not be able to make a savings withdrawal from the Fund on 1 September 2024. You will have to wait until you have at least R 2,000 in your savings component before you can withdraw this money.

Emergency Withdrawals: What to Know

If you have an emergency and want to withdraw from the savings pot, what do you need to know?

- You can withdraw a minimum of R 2,000 (before fees and taxes) once a tax year without leaving your employer.

- You will pay tax (marginal tax rates - which is the highest tax rate) and a processing fee on saving withdrawals.

- If you decide to withdraw your money from your savings component you need to notify the Fund. The Fund will not automatically transfer the money to your bank account.

- From 1 September 2024, one of the primary ways you will be able to withdraw from your savings component will be through the TSRF Online Benefit Counsellor Tool, we will give you more detail about the process within the next few months. For now please ensure that you are registered on the Benefit Counsellor.

- You can only start the process of withdrawing money from 2 September 2024 (first business day), and only if you have at least R 2,000 in your savings component (pot). It will take at least two weeks to process your request and for you to get your money.

- Remember that the tax and processing fee will be deducted so you will not receive the full R 2,000.

How will I know what the value of my savings pot is?

The Fund’s Benefit Counsellor will provide you with a balance on 2 September 2024 and the balance will also be shown on the annual benefit statement you receive from the Fund.

How do I register on the benefit counsellor?

Please click here and follow the instructions.

Think before Withdrawing

Please remember: The money in your savings component should also be saved for retirement and will be available as a cash lump sum when you retire.

Think carefully before you withdraw this money.

Contact Us

Please contact us if you have any queries.