Normal retirement age is 65 years and you may retire early from age 55 with the consent of your employer.

Contributions that are allocated towards retirement savings are invested by the Fund over the term of your membership.

How Retirement Savings Work

You will receive a benefit statement annually that will show how the money in the Fund is growing and what your savings in the Fund (Fund Credit) amounts to.

Member Contribution

Every month you pay 10% of your salary or wages as a contribution to the Fund. Your full contribution is invested for retirement.

Employer Contribution

Every month your employer pays 10% of your wages or salary as a contribution to the Fund, on your behalf.

A portion of the employer’s contribution goes towards the various costs including risk benefits and the remainder is invested for you by the Fund.

Legislation Changes

From 1 September 2024 the total of the Member and Employer contribution (after costs) are allocated as follows:

- two-thirds are allocated to the Retirement Component, and

- one-third is allocated to the Savings Component.

From 1 March 2021, it became compulsory for a provident fund member to buy an annuity (pension) at retirement with at least two-thirds of their accumulated retirement savings.

The Good News is that that provident fund members’ vested rights were protected and this means that members who joined the Fund before 1 March 2021 kept their right to withdraw their accumulated retirement savings as at 1 March 2021, plus the growth on them, as a lump sum cash benefit, even if they transfer to another retirement fund after 1 March 2021.

Two-Pot System

The Two-Pot legislation that came into effect on 1 September 2024 means that a member's Fund Credit now consists of the total of the Vested, Savings and Retirement components.

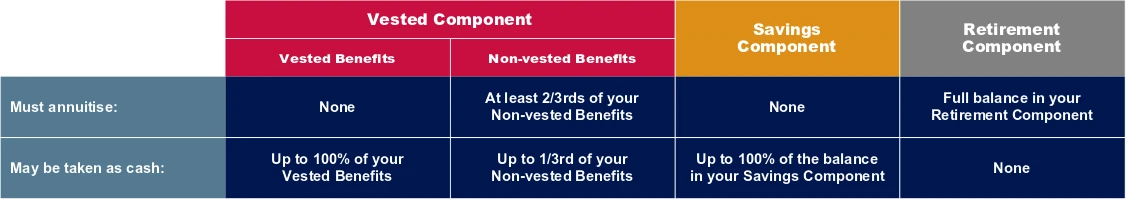

Vested Component

Vested Component may consist of vested and non-vested benefits depending on when a member joined the Fund. What is the difference between a vested benefit and a non-vested benefit?

The vested benefit is the member’s fund savings as at 1 March 2021 plus growth on the money until the member retires. At retirement this benefit can be taken as a cash lump sum.

The non-vested benefit is all the new contributions to the Fund from 1 March 2021 up to 31 August 2024. At retirement the member can only take one-third of this money as a cash lump sum and two-thirds must be used to buy a pension (compulsory or guaranteed life annuity).

Please note: If two-thirds of the non-vested “pot” together with the retirement "pot" is less than R165 000 (de minimis) this may be taken as a cash lump sum.

Savings Component

100% of the balance in a member's savings component may be taken in cash at retirement.

Retirement Component

100% of this benefit must be used to buy a pension/annuity for life.

Payment Of Benefit

A summary of the way in which the retirement benefit is paid is shown in the table below:

Annuitisation of Retirement Benefits

An annuity is a regular income that you can purchase from an authorised provider. It may also be referred to as a pension or income in retirement. You can purchase an annuity through the Fund (default annuity) or any other reputable service provider of your choice.

Click here to read more about the Fund's default annuity.

It is recommended that you read the Fund's Member Guide for more information and to see how to claim your benefit.

The Fund offers Retirement Benefit Counselling to help you understand your options at retirement.