In a defined contribution fund the member carries the investment risk, which means that you are exposed to the risk associated with fluctuations in the investment markets, i.e. markets can go up or down and this will affect the level of growth of the money invested.

Historically investment returns (growth both positive and negative) for the Fund were provided for as bonuses declared at the end of each financial year and allocated annually, to each Member’s Individual Account. An Interim Bonus was also declared to be paid to those members who exit the Fund before the declaration of a final bonus.

From 1 March 2014 the Fund's investments are allocated monthly. This allows the Fund to update member benefits with the full monthly investment returns earned by investments each month as opposed to bonus declaration arrangements whereby investment returns are declared only annually.

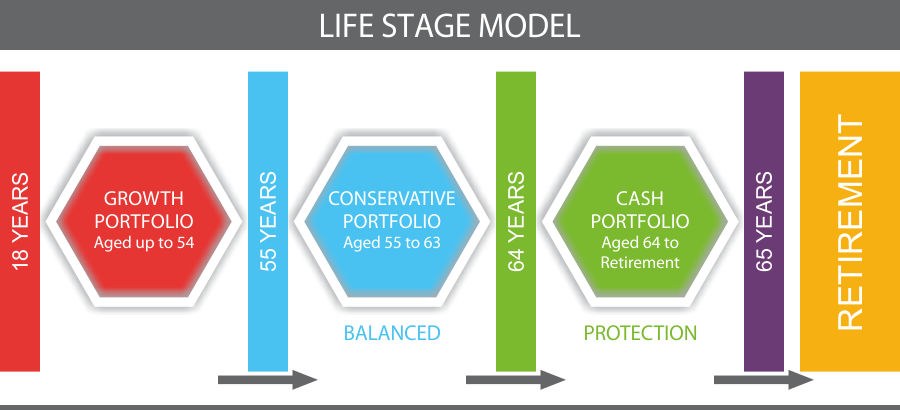

From 1 March 2018 the Fund implemented a default Life Stage Investment Strategy.

New Life Stage Portfolios

These new portfolios have been specifically designed to keep members' investments safe as they near retirement.

From 1 March 2018 members are automatically invested in one of these three Life Stage investment portfolios according to their age and remaining term to retirement. Members have the choice to opt for a different portfolio, this can be done via and election form from the administrators.

LIFE STAGE MODEL

As the member ages their term to retirement reduces. As a result, the level of investment risk they may be willing to take reduces as you want to make sure the value of your retirement fund benefit will not decrease just before you retire.

Did you know?

Investment risk is all about taking risk in order to grow money. The more risk you take the more growth you receive over the long term.

Portfolios that contain greater risk has more exposure to shares (equities) and are called aggressive portfolios. These portfolios are risky as they are volatile over the short term (will move up and down as the share market grows and falls). Over the long term aggressive portfolios provide better growth than balanced or cash portfolios.

Portfolios that are invested in cash provide protection against any capital losses, but over the long term provide lower returns than aggressive portfolios.

The first stage in the Life Stage investment strategy focuses on growing savings for retirement by investing retirement savings in the Growth Portfolio (that has more exposure to shares). When members are young and have a long time to retirement they can take more investment risk to increase potential investment returns.

As they move closer to retirement they will want to take less investment risk in order to protect the capital that they have accumulated for retirement from sudden market movements (volatility). The Life Stage model automatically moves investment from more risky to less risky investment portfolios, as members approach their retirement age.

Who are the Fund's Asset Mangers?

The Fund is committed to the ongoing transformation of South Africa for an inclusive economy by supporting service providers in the investment process that contribute significantly to the economic empowerment of targeted Black South Africans. The Fund believes in Black talent to manage and invest money. For the Fund, BEE is not a tick box compliance issue but a business imperative for growth and redress of the inequalities in our society.

The Fund policy is to have not less than 60% of the domestic assets of the Fund managed by Black owned and controlled investment management companies as defined in the Financial Services Charter and the Broad Based Black Economic Empowerment Codes of Good Practice.

Asset managers are appointed by the Trustees to exercise discretion in investing the assets of the Fund. The asset manager is expected to invest the Fund’s assets with the same care, skill, prudence and due diligence under the circumstance prevailing, that an experienced, professional asset manager acting in a similar capacity and fully familiar with such matters, would use in the investment of like assets with like aims.